In case you missed it see what’s in this section

Let's Talk

Filling Out a Short Tax Return for a UK Sole Trader - WISE Bookkeeping

We spoke to WISE Bookkeeping to see if they could offer their expert advice on navigating the confusing-yet-really-important job of filling out a tax return. Luckily enough, that's why we have our Ask the Experts series!

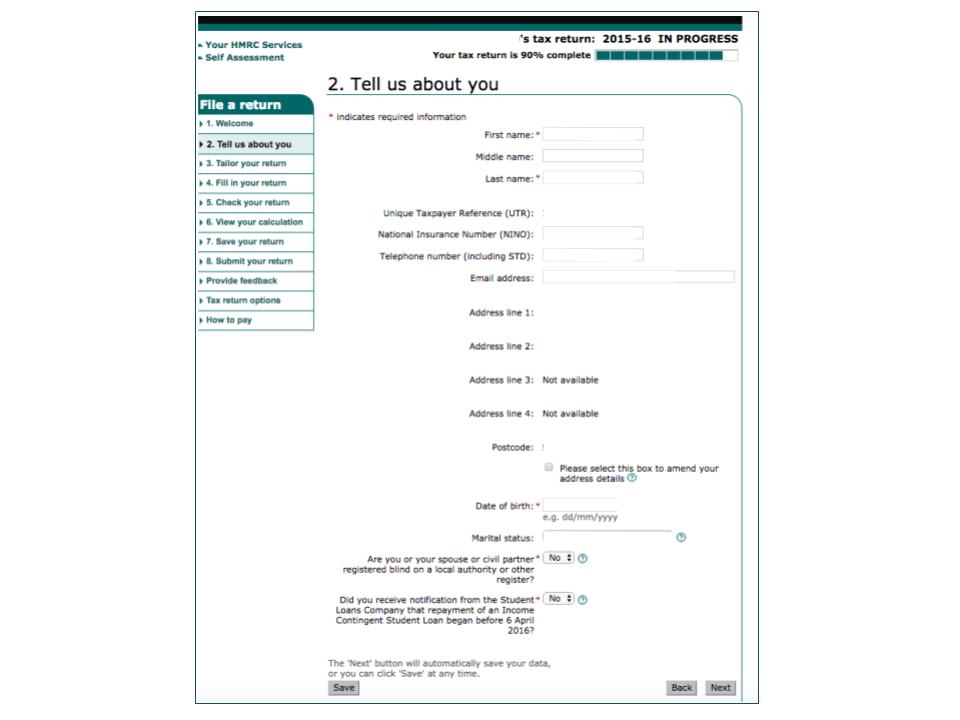

Section 2: Tell Us About You

This is the first section of filling out a Tax Return. I'm including it, because it is so easy, so for those of you who fill out your UK Tax Return for the first time, to break down the fear-barrier.

For those who are not first timers but are notorious procrastinators, logging in straight after the financial year has finished (after 5th April) and filling in this section, breaks down the 'procrastination barrier'. Part of it is already filled out for you anyway, based on your registration, or on your last year's records.

Take a look at the video and images below. I have included the explanation behind every little 'question mark' at the bottom of this page, so you can preview and prepare.

This means that by the time you are actually logging into your own, you'll get the 'filling out' part done quicker, as you have already done your reading by that point, so you will be more certain of your answers.

The images are from 2015/16 Tax Return.

On this particular page, there are few question marks/explanations, but as you will go deeper into the return, there will be more and more and the explanations will also grow.

Filing a Tax-Return is basically a written conversation between you and HMRC, regarding your circumstances that were relevant to the financial year you are filing for. Therefore sections 2-3 will be about your address, and alike basic information about you as a person and your earning activities as a self employed person or business. Most of the rest of the questions in section 2-3 are closed questions with Yes or No answers.

These parts are the easiest, which is why it is a good idea to get them sorted ASAP, before moving onto the more detailed part 4.

It is important to remember the time-frame restriction when answering these questions. The questions on each return need to be answered based on only the relevant financial year. Pay particularly more attention if your circumstances have changed from previous financial year(s).

It is probably needless to say, but best to include anyway, that a financial year in the UK goes from 6th of April till the 5th of April the following year. E.g. 2016/17 will go:

FROM: 6th April 2016

TO: 5th April 2017

However, by the time you get to fill out your return, the financial year that you are filling out the return for, will be 2016/17 for 2015/16 for example. So you will need to remember the circumstances that applied back in the previous financial year. And prepare your books between these dates, whether or not you have been carrying out your Self Employed activity for the full 12 months between these dates or less.

I know all of this is obvious but I'm only mentioning as related queries keep coming up in conversations I'm having with my Tax Return clients.

Thank You for Reading / Watching. Hope you've found it helpful.

We are always looking for questions and feedback, so if you have still not resolved your query by watching / reading this, please send us your question to

[email protected] so we can reply to you 1:1 to help you resolve your query.

You are always welcome for a visit on our website too www.wise-bookkeeping.co.uk or connect to us via Facebook, Twitter or YouTube.

Weather in Swindon

Listings